What Trends Are Ahead for the U.S. and Bay Area Housing Markets?

Executive Summary:

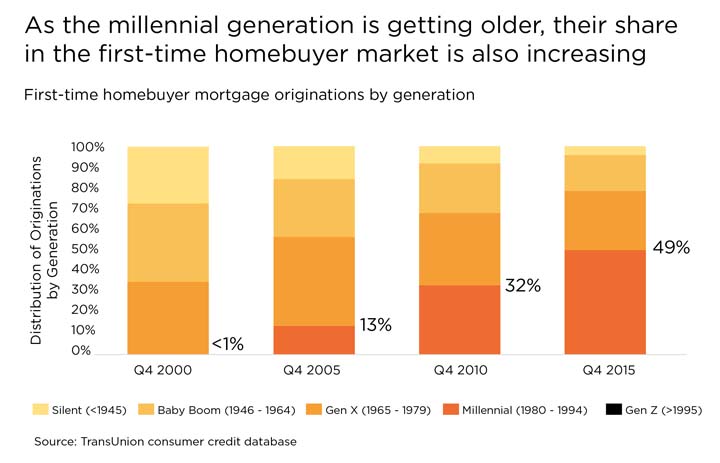

- Millennials are increasingly active buyers and now represent about 50 percent of first-time buyers in the U.S. California’s affordability constraints hold back the first-time buyer share at 30 percent.

- Minorities will also emerge as a hypergrowing demographic of homebuyers in the U.S. By 2020, minorities will account for all growth in homeownership.

- Mortgage creditors will need to consider the changing face of homebuyers and accommodate their needs and cultural differences.

- In San Francisco, the share of income spent on rent is 46 percent, up from 31 percent historically. The share of income spent on mortgage payments is 41 percent, up from 39 percent historically.

- Affordability constraints are especially challenging for the bottom two-thirds of income levels, where a lack of supply is particularly problematic.

- Income inequality has been increasing dramatically over time. The share of middle-income households nationally decreased from 65 percent in the 1970s to 40 percent today.

I recently attended the “Housing Renaissance” conference in San Diego. The event featured some of the smartest housing analysts in the country, and the following six major themes emerged in the discussions¹:

The Millennial Generation

- Millennials are more educated than any generation before them, hence they carry large student debt, but their education allows them higher income-growth potential over their lifetime.

- Student debt affects only those who didn’t actually finish school. If they had obtained a degree — even with student debt — the probability of homeownership has remained consistent over time.

- The oldest millennials — who are now 34 — are 38 percent more likely to have a bachelor’s degree than previous generations. At the age of 34, 21 percent of baby boomers and 36 percent of Gen Xers had a B.A.

- First-time buyers are rebounding strongly and now represent 50 percent of buyers. In California, the share of first-time buyers remains lower because of affordability constraints.

- One important factor holding back homeownership rates among millennials is the decline in marriage rates. In 1980, 53 percent of those between age 20 and 36 were defined as currently married. Today, only 26 percent of the population age 20 to 36 are defined as currently married.

- Millennials are now moving into age groups with higher headship rates, meaning they will start creating households at a higher rate than in the last few years.

- TransUnion estimates that the market will see 12 to 16 million first-time buyers over the next five years.

Figure 1:

Source: Joe Mellman, vice president, Financial Services, TransUnion.

- But first-time buyers, which include both millennials and/or Gen-Xers, tend to purchase homes in noncoastal areas. Thirty-three percent of first-time buyers purchased homes in coastal areas, whereas 67 percent of millennials bought in noncoastal areas

- Still, there will be continued interest in renting because the generation is so large and the youngest millennials are still only 20 years old.

- One cautionary sign are apartment property prices in hot markets, which have surged well above previous peaks.

Ethnic Diversity

- Minorities will account for the vast majority of net household growth over the next decade

- However, whites are on average significantly older than Hispanics. In fact, a large share of the Hispanic population is beginning to enter the traditional homebuying age, and they will represent the majority of homebuyers in the future. Figure 2 illustrates the age distribution of the white and Hispanic populations. More than 80 percent of Hispanics are younger than 50 years of age.

Figure 2:

Source: Mark Fleming, chief economist, First American

Homeownership

- Housing is the primary source of wealth creation for the bottom 40 percent of the income distribution.

- The U.S. homeownership rate has been falling for a number of reasons. The rate is a ratio of homeowners to households, and since there are more households being created than homeowners, the ratio is falling. Millennials are also marrying and having children later than previous generations.

- However, interest in homeownership is not fading. The vast majority of households who currently do not own expect to own in the future. For persons between 30 and 39, about 14 percent expect to buy a home someday, and 17 percent expect to buy a home when they next move. For those under the age of 30, 28 percent expect to buy a home in the next move, and 33 percent expect to buy someday.

- Homeownership differs vastly by race, which is partly due to income and wealth inequalities.

- By the 2020s, minorities will account for all growth in homeownership.

- Nevertheless, a rental surge is continuing: 59 percent of the 22 million new households that will form between 2010 and 2030 will rent rather than buy their homes. The housing market is not prepared for this, and therefore rents will likely continue to increase.

- Some analysts are forecasting the U.S. homeownership rate to continue to drop from 65.1 percent in 2010 to 61.3 percent by 2030. A larger proportion of minority households who will become homeowners will be offset by an aging population, who will exit homeownership.

Housing-Finance Reform

- Given the high likelihood that the Democratic Party will win the upcoming presidential election, housing reform is most likely to remain in status quo. Democrats will focus on the following: preserving the 30-year, fixed rate mortgage; modernizing credit scoring; clarifying lending rules; expanding access to housing counseling; defending and strengthening the Fair Housing Act; and ensuring that regulators have the clear direction, resources, and authority to enforce those rules effectively. The party will also prevent predatory lending by defending the Consumer Financial Protection Bureau.

Affordability

- Affordability is a real concern in many parts of the country. However, when adjusted for mortgage rates, real home prices are still well below historic levels nationally, though not in California.

- Nevertheless, real incomes are flat, especially for the lowest two-thirds of the income distribution, which is a serious concern for affordability.

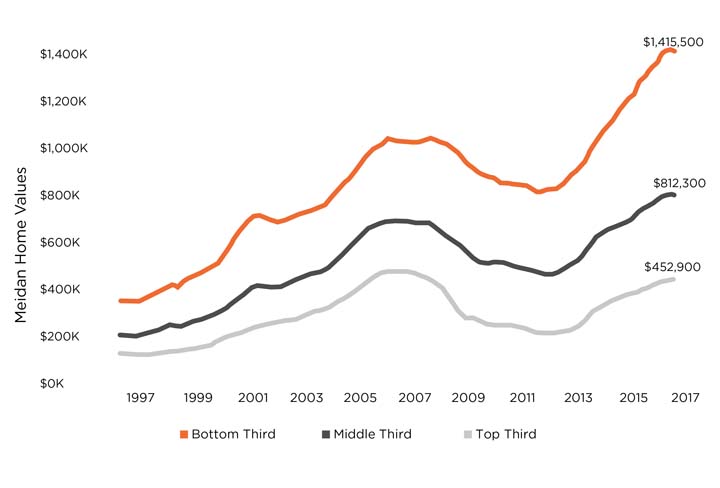

- Affordability constraints are especially striking in expensive markets. In San Francisco, the share of income spent on rent is 46 percent, and the share of income spent on mortgage payments is 41 percent. Historically, those shares were 31 percent and 41 percent, respectively. The highest-tier home-price segment grew fastest in the last recovery and has flattened out. But now, the bottom one-third of home values are appreciating at the fastest rates.

The charts below are adopted from a Zillow presentation and represent median home-value changes in San Francisco:

Figure 3:

Source: Svenja Gudell, chief economist, Zillow

Annual home-price appreciation in San Francisco by price tiers:

Figure 4:

Source: Svenja Gudell, chief economist, Zillow

Being able to afford a home in bottom one-third of home-price distribution for households with an income in the bottom one-third of income distribution is incredibly difficult. Figure 5 below shows that a household in San Francisco would need to spent almost 70 percent of its income on a mortgage payment.

Figure 5:

Source: Svenja Gudell, chief economist, Zillow

Rental affordably for the same group of people is virtually impossible. A household in the bottom one-third of income distribution would need to spend 90 percent of its income on rent in San Francisco.

Figure 6:

Source: Svenja Gudell, chief economist, Zillo

While the number of cost-burdened homeowners has fallen due to lower mortgage rates, the number of cost-burdened renters has reached a new high. Furthermore, high rents make it difficult to save for a down payment, which is a major impediment to purchasing a home for first-time buyers.

- Income inequality has been increasing dramatically over time. The share of middle-income households nationally decreased from 65 percent in the 1970s to 40 percent today.

- The affordability crisis is further exacerbated by persistent supply constraints. According to Laurie Goodman at the Urban Institute, the U.S. is currently undersupplied by 430,000 units annually. Inventory shortages are particularly acute for homes in the bottom- and middle-third price tiers of the market.

Figure 7:

Source: Chris Herbert, managing director, Harvard Joint Center for Housing Studies

The Mortgage Market

- There has been an increase in purchase applications from last year, with broad improvement by loan sizes.

- Independent mortgage lenders continue to gain market share and accounted for 43 percent of the market in 2014. They accounted for 23 percent in 2007, and today the share is most likely even higher. Commercial bank share was down from 74 percent in 2007 to 52 percent in 2014.

- The origination business remains tough due to cost overlays. In addition, production expenses increased from $5,800 in 2011 to $7,800 per transaction now, which is largely driven by increases in personnel expenses. Mortgages are also more time-consuming to underwrite, with servicing costs increasing from $59 in 2008 to $158 in 2014 for performing loans and from $482 in 2008 to $1,949 in 2014 for nonperforming loans.

- Credit availability remains very tight.

- Since minorities will account for all growth in homeownership, the mortgage industry must adjust credit access to account for differences in cultural preferences. For example, Hispanics mostly pay with cash and therefore lack credit histories. Minorities also often buy homes as multigenerational households, and income sources come from more than two people.

- One of the challenges for potential homeowners is their ability to access credit markets, of which the first step is being credit “scoreable.” There are a large number of potential homeowners who are currently invisible based on an analysis by VantageScore, representing about 11 percent of the U.S. population and significantly more if one considers only the adult population.

- According to new scoring developed by VantageScore, there are additional consumers that are not being included under conventional scoring methods. According to VantageScore’s new scoring system, there are addition 21 million consumers with scores between 500 and 580, 6 million additional consumers with scores between 580 and 620, and 7.6 million consumers with scores between 620 and 850.

Selma Hepp is Pacific Union’s Chief Economist and Vice President of Business Intelligence. Her previous positions include Chief Economist at Trulia, senior economist for the California Association of Realtors, and economist and manager of public policy and homeownership at the National Association of Realtors. She holds a Master of Arts in Economics from the State University of New York (SUNY), Buffalo, and a Ph.D. in Urban and Regional Planning and Design from the University of Maryland.

¹ The information is taken from presentations from:

Laurie Goodman, co-director, Housing Finance Policy Center, Urban Institute; Chris Herbert, managing director, Harvard Joint Center for Housing Studies; Svenja Gudell, chief economist, Zillow; Mike Fratantoni, chief economist, senior vice president research & industry technology, Mortgage Bankers Association; Mark Fleming, chief economist, First American; Barrett Burns, president & CEO, VantageScore; Joe Mellman, vice president, Financial Services, TransUnion.